Featured

- Get link

- X

- Other Apps

How Is Apprenticeship Levy Calculated

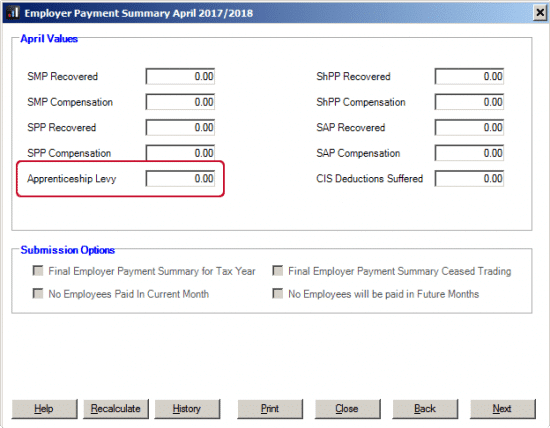

How Is Apprenticeship Levy Calculated. The apprenticeship levy was initiated by the uk government in april 2017, for all employers paying a wage bill of more than £3 million per year. It is collected through the pay as you earn process alongside other.

The government will then top up this amount by 10% and place this into your digital account ready for you to invest in apprenticeship training. Employers with a pay bill of over £3 million pounds per year are automatically required to pay apprenticeship levy as part of their paye liability. Apprenticeships deliver the skills both organisations and employees need to achieve their goals.

How The Apprenticeship Levy Works For Levy Payers

The apprenticeship levy was initiated by the uk government in april 2017, for all employers paying a wage bill of more than £3 million per year. The levy is paid by large employers with a pay bill of over £3 million (they pay 0.5% of their total annual pay bill). The government apprenticeship levy is a form of taxation designed to help companies offer more apprenticeships.

All Employers With Annual Pay Bills Of £3M Or More Must Pay The Levy At A Rate Of 0.5% Of The Company’s Total Pay Bill, Minus A Fixed £15,000 Annual Allowance.

Apprenticeships deliver the skills both organisations and employees need to achieve their goals. It was introduced to benefit businesses by boosting essential training and developing apprenticeship programmes. The levy is payable through paye, alongside income tax and national insurance.

For A More Detailed Look At How The Apprenticeship Levy Gets Calculated.

Specifically, the tax is 0.5% of the company’s gross payroll. It’s paid to hmrc alongside income tax and national insurance. Our handy apprenticeship levy calculator is here to help you estimate your apprenticeship levy funding.

Your Levy Payment Amount Is Calculated Using This Simple Formula:

The calculation for apprenticeship levy is below: Prior releases gave this total at the department level. How is your levy and total amount to invest calculated?

What Is The Apprenticeship Levy Calculated On?

A company with an annual pay expense of £5 million, for example, will be taxed £10,000 per year. The levy is a small tax charge, payable by all companies with an annual wage bill in excess of £3m. Employers that meet this criterion are now required to pay 0.5% of their payroll each month as a levy tax.

Comments

Post a Comment